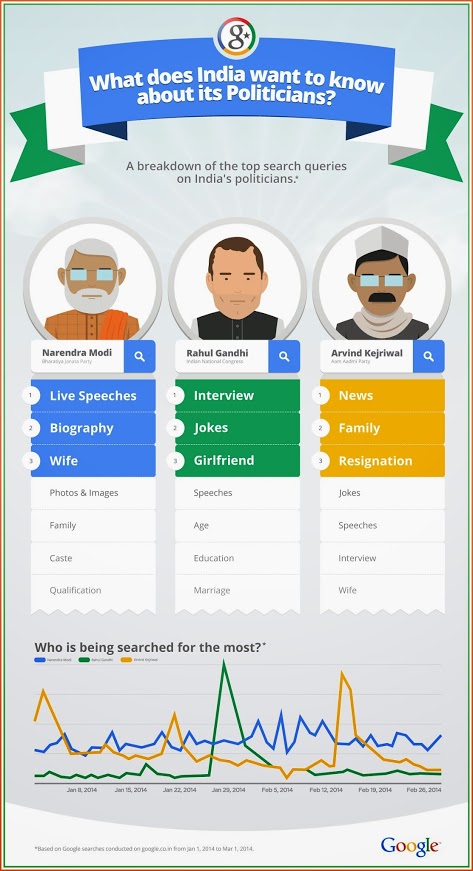

The differences in the search terms are also telling.

Narendra Modi

As with everything else regarding the Bharatiya Janata Party’s prime ministerial candidate, the searches for his wife carry with them an undercurrent of conspiracy, or at least of something hidden.

In 2009, Open magazine tracked down Jashodaben Chimanlal Modi, a schoolteacher in Rajosana who is reportedly married to the Bharatiya Janata Party’s prime ministerial candidate. Modi never contested the claims made by the magazine, prompting many to believe that there must be some truth to the story.

His marriage remains a touchy subject, partly because of rumours that it was a child marriage and partly because of the Rashtriya Swayamsevak Sangh, of which Modi was a member, requires cadres to take a vow of celibacy. One frequent theory suggests that Modi was married as as a child, but never carried out the gauna ritual, where the couple who were wed in childhood consummate the marriage as adults. The 62-year-old Jashodaben told the Indian Express earlier this year that she got married to Modi at the age of 17, and they separated three years later.

On his part, Modi has always maintained complete silence on the matter.

Rahul Gandhi

The Congress vice president and heir apparent Rahul Gandhi has been a little more forthright about his personal life. News articles often turn up referring to the Nehru-Gandhi scion as India’s “most eligible bachelor,” but in an interview last year Gandhi said he wasn’t interested in marriage. That tune seems to have changed, with Gandhi telling PTI just a few days ago that he will marry when he “finds the right girl”.

The search term that is most popular, though — as with his mother — has a foreign connection. Gandhi was photographed with a foreign woman at a Cricket World Cup match in England in 1999, around the time Sonia Gandhi’s citizenship had also become a political issue, and then again in several photos since. By 2004, the press had anointed the woman ‘Juanita,’ and she was widely referred to as his ‘Colombian girlfriend.’ Until, that is, Gandhi told The Indian Express in Amethi that, “my girlfriend’s name is Veronique, not Juanita... she is Spanish and not Venezuelan or Colombian. She is an architect, not a waitress, though I wouldn’t have had a problem with that. She is also my best friend.”

Arvind Kejriwal

True to form, while Modi and Gandhi have complicated answers to the relationship question, former Delhi Chief Minister Arvind Kejriwal is much more transparent. Kejriwal’s family appears to be the second most common query about him on Google, after ‘news’ and above ‘resignation.’

Kejriwal lives with his wife, two children and his parents. The family is regularly profiled in the media, and Kerjiwal — who is a fan of referendums — reportedly went to them first when before going to the public when deciding whether he should take up the post of being Delhi’s chief minister.