And then a company like Apple comes along, just to provide a reality check. Apple is huge. Gigantic, in fact. It may seem like a niche company in India, where its high-end phones have only 2% of the marketplace, but globally it is a behemoth. By itself it accounted for 18% of the rise of the entire Standard & Poor’s 500 index last year and according to JPMorgan Chase’s chief economist, the company is responsible for the US Gross Domestic Product growth by a fourth to a third of a percentage point.

On Wednesday, the behemoth got even bigger. Steve Jobs’s company managed a record $74.6 billion in revenues between October and December 2014. That’s not just a record for Apple. That’s the biggest quarter any company has had in history.

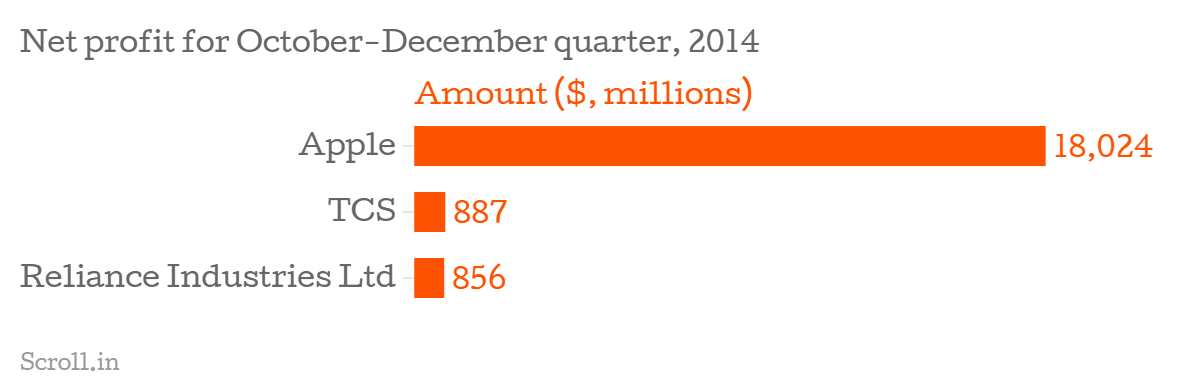

Just to give that context, here’s a look at how Apple’s massive numbers stack up next to India’s economy. India’s most profitable companies happen to be Tata Consultancy Services and Reliance Industries Limited, two of the economy’s stalwarts. TCS in fact made waves last quarter for beating RIL in the profitability charts for the first time since 1992-'93, when Tata Steel was tops. All of those numbers, of course, look tiny compared to Apple.

But maybe that’s not fair. It’s not an apples to apples comparison, considering the massive advantages Apple Inc. has by dint of being part of the American economy. So instead, why not compare Apple’s performance to India’s entire information technology industry, which powered the mid-2000s boom?

Even that might be an incomplete comparison, since those companies focus on tertiary services and Apple makes a huge part of its revenues through hardware sales, thanks to the iPhone and Macs. Only if we stack up Apple’s annual profits in 2014 against the profits recorded by India’s top 100 companies over the same year do we finally end up with a graph where Apple loses out, but not by much. Remember, it is just one company up against our top 100.

Last year saw the true arrival of the smartphone and the tablet in the Indian market, with a new phone seemingly being launched every other day. Headline after headline spoke about websites crashing because of demand and sales ending in a few seconds. That might have something to do with supply too, considering Apple’s iPhone sales in the October-December period alone beat out total smartphone sales in India in 2014.

And finally, we might consider Bollywood big business, with TV, music, newspapers and magazines added to that. Yet a composite calculation of the value of the entire Indian media economy in 2014 is not a whole lot higher than the sales Apple registered on iTunes in 2014.