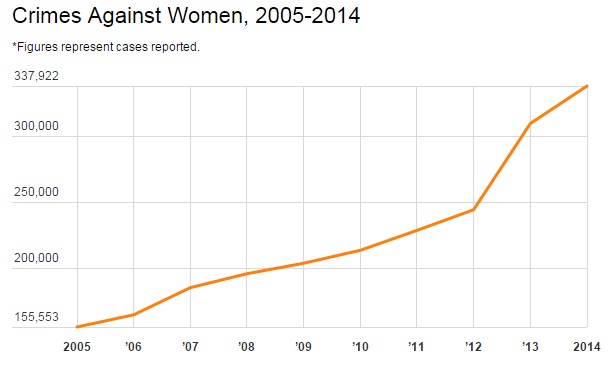

As many as 2.24 million crimes against women were reported over the past decade: 26 crimes against women are reported every hour, or one complaint every two minutes, reveals an IndiaSpend analysis based on the last decade’s data.

The semantic meaning of “crime against women” is direct or indirect physical or mental cruelty to women. Crimes directed specifically against women and in which only women are victims are characterised as “crimes against women”.

Source: National Crime Records Bureau

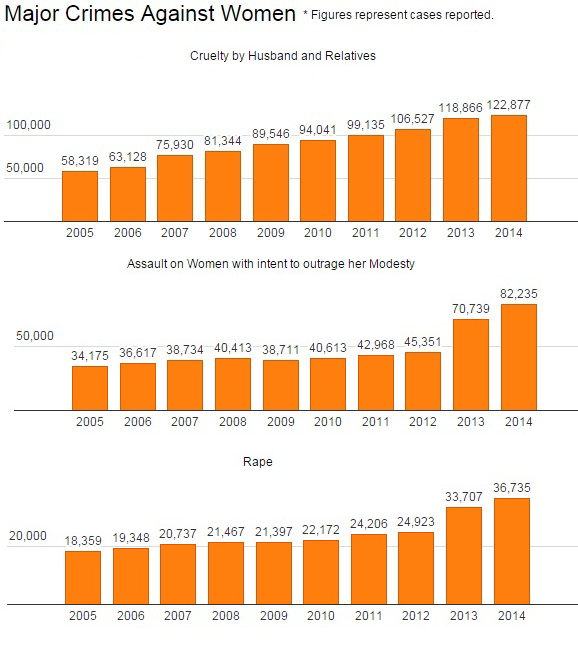

Cruelty by husbands and relatives under section 498‐A of Indian Penal Code is the major crime committed against women across the country, with 909,713 cases reported over the last 10 years, or 10 every hour.

Source: National Crime Records Bureau; Figures represent cases reported. Note: Cruelty by Husband and Relatives (Section 498‐A IPC); Assault on Women with Intent to Outrage Her Modesty (Section 354 IPC); Kidnapping & Abduction of Women (Section 363,364,364A, 366 IPC); Rape (Section 376 IPC); Insult to the Modesty of Women (Section 509 IPC); Dowry Deaths (Section 304‐B IPC).

Assault on women with intent to outrage her modesty (470,556), earlier classified as molestation under section 354 of IPC, is the second-most-reported crime against women over the last decade.

Kidnapping and abduction of women (315,074) is the third-most-reported crime followed by rape (243,051), insult to modesty of women (104,151) and dowry death (80,833).

More than 66,000 cases have been reported under the Dowry Prohibition Act, 1961, over the last decade.

Ten cases of cruelty by husband and relatives are reported every hour across the country followed by cases of assault on women with intent to outrage her modesty (5), kidnapping & abduction (3) and rape (3).

NCRB added three more heads under which cases of crime against women have been reported in 2014.

These include attempt to commit rape (4,234), abetment of suicide of women (3,734) under section 306 IPC and protection of women from domestic violence (426).

As many as 66% of women reported experiencing sexual harassment between two and five times during the past year, a 2010 study in New Delhi had found.

Andra Pradesh leads in crimes against women

Andhra Pradesh has reported the most crimes against women (263,839) over the past 10 years.

The state ranks first in crimes reported for insult to modesty of women (35,733), second in cruelty by husband and relatives (117,458), assault on women with intent to outrage her modesty (51,376) and fourth among dowry-related deaths (5,364).

Source: National Crime Records Bureau. Note: Andhra Pradesh figures for 2014 are inclusive of Telangana.

West Bengal (239,760) is second, leading in crimes related to cruelty by husband and relatives (152,852), second in kidnapping and abduction (27,371) and fifth in dowry-related deaths (4,891).

Uttar Pradesh (236,456) ranks third, followed by Rajasthan (188,928) and Madhya Pradesh (175,593).

These five states account for almost half of all the crimes committed against women across the country over the last decade.

Kidnapping of women up three times

Kidnapping and abduction of women is up 264% (a more than three-fold increase) over the past ten years, from 15,750 cases in 2005 to 57,311 cases in 2014. Uttar Pradesh is the worst-affected state, with 58,953 cases reported.

Police investigations have found that in places like Delhi, Agra, Madhya Pradesh and Rajasthan, denotified tribes (also known as criminal tribes), such as Bedia, Nat, Kanjar and Banjara, are involved in kidnapping minor girls, according to a report by the United Nations.

These tribes raise kidnapped girls as their own daughters, and then send them to Mumbai and Middle East to work in dance bars, brothels and escort services.

Madhya Pradesh (34,143) reported the highest number of rape cases in the last decade followed by West Bengal (19,993), Uttar Pradesh (19,894), Maharashtra (19,177) and Rajasthan (18,654).

Madhya Pradesh (70,020) also reported the most cases of assault on women with intent to outrage her modesty.

Around 35% of women globally have experienced either physical or sexual intimate partner violence or non-partner sexual violence, according to a 2013 global review by UN Women.

Some national violence studies show that up to 70% of women have experienced physical or sexual violence in their lifetime from an intimate partner, the UN report said.

This article was originally published on IndiaSpend.com, a data-driven and public-interest journalism non-profit.