At a press briefing on Monday, Ajay Maken, spokesman for the All India Congress Committee, produced a copy of the website on which the Gujarat government had specified this figure. His attack was clearly meant to be a belated riposte to the BJP's criticism last year of the Congress-led central government's definition of the poverty line.

In late July, the planning commission had released poverty estimates for India and individual states. For India, it had set Rs 27.20 of daily consumption expenditure as the cut-off for rural poverty and Rs 33.33 for urban poverty. For Gujarat, it had set the rural poverty line at Rs 31.07 and the urban poverty line at Rs 38.40 -- the national figures being a weighted average of the estimates for all states.

At that time, the BJP had rebuked the central government for fixing the poverty line so low. By doing so, the United Progressive Alliance-II government was in effect saying that anyone who spent more than that amount was not poor, the BJP said. This week, after the Congress hit back, the Gujarat government responded by saying that it was merely following instructions issued by the planning commission in 2004.

Whatever the truth about the source of the latest figure, namely Rs 10.80, these politically-motivated attacks from both parties threaten to obscure the big picture about Gujarat's mediocre record on poverty alleviation over a period when the Bharatiya Janata Party's Narendra Modi has been the chief minister. He is now in his fourth term.

The Gujarat government has constantly spoken about how well the state's economy has fared under Modi. But if we look at its record on poverty alleviation, which clearly is, or should be, a key economic metric, especially in a country like India, we see that it has not done well.

Before looking at the evidence, it is necessary to first set aside the controversy being fanned by the Congress and the BJP by showing that their attacks against one another are based on a flawed premise -- that setting the poverty line at a particular level constitutes a value judgment.

Defining the poverty line at a particular level of daily consumption does not imply that anything above this amount is adequate or that those who spend slightly more are not poor, said Mihir Shah, a member of the planning commission.

The whole controversy can, in fact, be demolished in one go if the commission merely adds the epithet "abject" to the term "poverty line", making it clear that those above this line may also be poor, that poverty has different degrees and that standard of living estimates form a continuum.

It is true that this cut-off has practical implications if it is used to determine beneficiaries to various welfare programmes, as many state governments do. In practical terms, this means that anyone who wants to avail him- or herself of a scheme that uses this measure must have a below-the-poverty-line card, a system that is mired in corruption.

But the controversy between the Congress and BJP is not about this.

Furthermore, many big welfare schemes of the central government are either universal, such as the MGNREGA, an employment guarantee scheme and mid-day meals, which anyone can apply for. For other schemes, the Centre is moving towards using specific parameters that are relevant. For instance, to ascertain beneficiaries under the food security law, everyone except those who pay income tax will be eligible. "It is a way of eliminating the really rich," said Shah.

So why bother defining a daily consumption expenditure cut-off? Despite its analytical and practical limitations, it is a convenient measure to use to evaluate how countries or states have fared across time or to compare states with one another in a given year, said Shah.

But it is not the only indicator. This measure, i.e. daily consumption expenditure or a person's daily spending on goods and services, is only one of many that can be used to gauge the extent of poverty or the efficacy of poverty alleviation. Economists and policy makers the world over are moving from this consumption expenditure approach towards a more multi-dimensional approach that looks at overall deprivation.

The Oxford Poverty and Human Development Initiative and the United Nations Development Programme developed the multidimensional poverty index, or MPI, in 2010. It uses several parameters to determine poverty besides just income and consumption. These fall under the three categories of health, education and living standards. The approach is commendable but the index is yet to be applied to India with up-to-date data, said Shah.

But other telling indicators already exist. Rural wages of casual labour and leakages in the public distribution system also provide an insight into how a state has dealt with poverty, said Himanshu, an economist and expert on poverty and inequality at the Jawaharlal Nehru University in Delhi.

So we can look at Gujarat's record on all three parameters.

Let us first look at consumption expenditure, or spending on goods and services. The percent of people in poverty (below the cut-off) decreased from 2004-2005 to 2011-2012 in all states except three, according to the planning commission's data and based on its definition of the poverty line for different states.

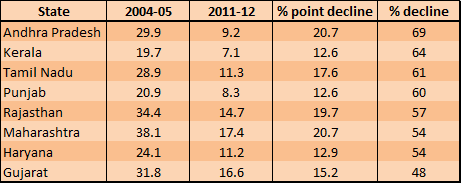

But the extent of the decline varied across states, and here, of all big states, Gujarat ranked 8th in percentage decline (column 4) of the percentage of people below the poverty line.

If we look at the second indicator, namely wages of casual workers, who constitute about one-third of the labour force, Gujarat again fares badly. The data -- from the National Sample Survey's employment survey – cover the same time period, i.e. between 2004-05 and 2011-12, the wages of casual workers in Gujarat grew by 3.3 percent a year, the lowest of all major states, including Odisha and Bihar, where they grew by 8.3 percent and 7.8 percent a year respectively, said Himanshu of JNU.

Moreover, if you compare the rise in rural wages with the rise in per capita income, you can gauge who has gained from overall economic growth. In Gujarat, growth in rural wages is less than half of growth in per capital income, while in Bihar and Odisha it is the same or higher. "This shows that growth in Gujarat has not been equitable," he said.

Finally, in terms of the third indicator, namely leakages in the public distribution system, a specific welfare mechanism for poverty alleviation, Gujarat fares particularly badly. In 2011-2012, of all big states, Gujarat had the highest leakage in its PDS, as measured by methods widely accepted by economists, with the figure rising to 69 percent from 45 percent in 2009-10, said Himanshu.

Again, Bihar, which has historically fared badly on this parameter, has dramatically improved in recent years. Leakages dropped from 65 percent in 2009-10 to 12 percent in 2011-2012.

Therefore, to conduct a serious discussion about poverty anywhere, including in Gujarat, one needs to look at the poverty line as a means of measuring how a certain section of the population has fared over time and not as an implication that people who fall above it are not poor. Moreover, this measurement has limitations and other equally if not more revealing indicators, such as rural wages of casual labour and leakages in the public distribution system, exist.

Do the two parties not understand these elementary facts or are they glossing over them to score political points? Either way, they don't come out looking good.