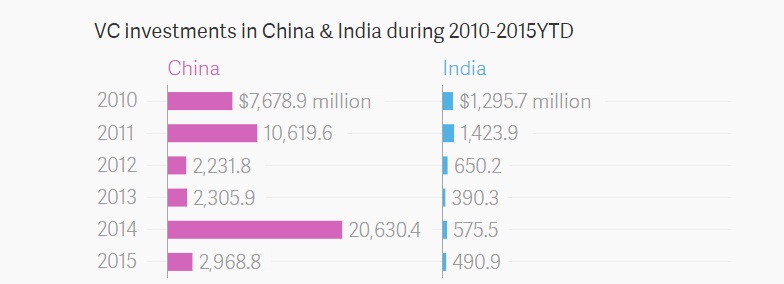

With China now targeting a minimum growth rate of 6.5% a year until 2020 – the lowest growth forecast that the country has had since the late 1970s – India stands to siphon off some of the venture capital that otherwise might have flowed into China.

“Venture Capitalists make strategic bets on countries, regions, companies – and therefore, to an extent the slowness in China may be of help to Indian companies from a funding perspective,” said Yugal Joshi, who leads the digital research practice at Everest Group, a US-based research and consulting firm.

Closing the gap

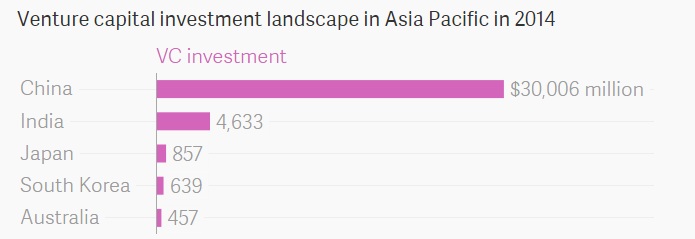

And while a number of new investors have arrived in India of late – including Chinese e-commerce giant Alibaba, Japanese internet major SoftBank, and Google Capital, the late-stage venture capital fund of the internet search giant –it will take a lot for India to close the gap with China, which currently gets the lion’s share of the venture capital money in the Asia-Pacific region.

Data: Thomson One Banker.

According to the research and analytics firm Aranca, the region overall attracted $38.9 billion (Rs 2,55,000 crore) in venture capital investments in 2014, trailing only North America’s $59.9 billion. “With China’s economy showing signs of subdued growth in recent years, investors might turn their attention toward India in the long run,” Aranca wrote in a recent report on the region’s evolving venture capital market.

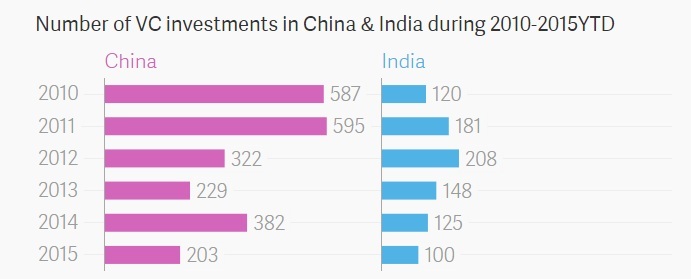

The key phrase to keep in mind here is “long run.”

“From a business perspective, we still hear a lot more about China than we do about India,” said Anand Sanwal, the New York-based chief executive officer of research firm CB Insights.

Of course, old habits can be hard to break – and steering venture capital money into China over India is indeed an old habit.

Data: Thomson One Banker.

Data: Thomson One Banker.

But China’s economic slowdown could prove to be a major accelerant for a change in investor habits – and for India’s startups.

This article was originally published on qz.com.