The opposition, the Congress and the Nationalist Congress Party, have been stalling the monsoon session of the legislature since it opened last week. Soon after Fadnavis concluded his speech on Monday, the opposition walked out of the assembly. Last week, among other publicity stunts, opposition leaders sat on the porch of the assembly to draw attention to their demand.

The opposition leaders want the Fadnavis government to waive off outstanding loans of farmers who have been mired in debt and whose financial condition has been worsened by a combination of natural and man-made factors in the last two years: drought, hailstorms, followed by a drought, hailstorms and floods, minimum support prices that do not even match input costs, tardy implementation of relief measures announced in the recent months and so on.

The Shiv Sena, formally an ally in the Fadnavis government, too stepped up the ante against (its own) government on this demand. Sena chief Uddhav Thackeray used public platforms to put pressure on the government, though he can use other channels to persuade Fadnavis to his viewpoint. Some BJP leaders, wittingly or otherwise, issued contrary statements on waiving off the debt.

Set against the rapidly rising incidence of farmer suicide in both Vidarbha and Marathwada regions, the escalating demand for debt waivers seems appropriate. But the fact that the Congress and NCP are raising the demand makes it cynical. Between 1999 and 2014, while they were in power, the state’s farm crisis worsened and farmers’ condition deteriorated.

Now, as farmers become convenient fodder for politicians to score brownie points and indulge in a game of one-upmanship, Maharashtra’s farmers are trapped between the debt-waiver and debt-free approach to resolving the crisis. Should they be debt-free? That’s a no-brainer. Will a debt waiver at this juncture save some of them from going over the edge? That’s a no-brainer too.

The deep end

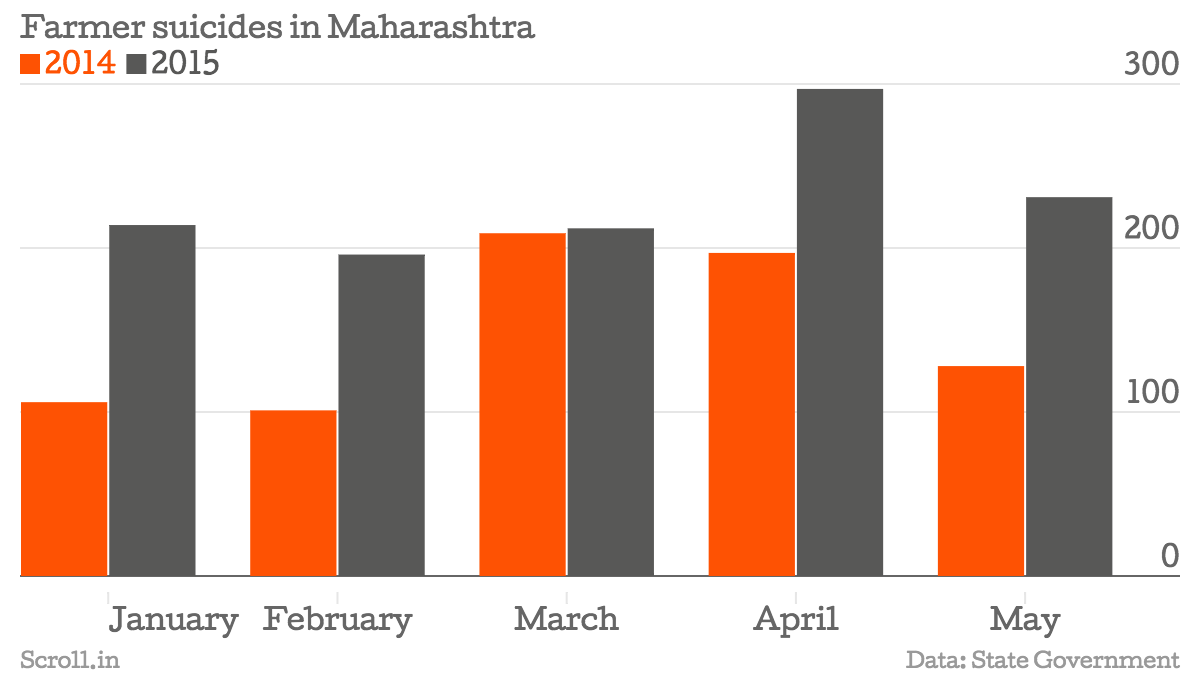

There has been an alarming 55% increase in farmer suicides in the first five months of this year compared, month on month, to last year. As many as 1,150 farmers committed suicide between January and May this year against 741 last year. This is government data; activists say the situation is far worse.

As the extended dry spell in July ruined large acreage of sown crop, a group of seven farmers in Wardha in Vidarbha region sought “permission” from the government to commit suicide, according to local reports. The group from Wadad village, comprising three women and four men, submitted a memorandum to the local tehsildar earlier this month seeking his clearance to take their lives. They got an official acknowledgment. They then proceeded with the letter to the district collector’s office where too they received an acknowledgment on the letter.

This is a farcical tragedy, says Kishore Tiwari, an activist who has tracked farmer suicides in Vidarbha for over a decade through the Vidarbha Jan Andolan Samiti. The group was running from pillar to post for six months trying to get the aid of Rs 4,000 per head that was announced as per government norms after the drought, hailstorm and floods last year. “The money is in bank accounts but not disbursed,” said Tiwari. Even if they had received the relief, it would have hardly covered their losses which, according to Tiwari’s estimates, are Rs 8,000 to 10,000 per acre.

The unusually heavy rain in June followed by the untimely dry spell this month means further losses for farmers but this government does not comprehend the situation, say opposition leaders. The Fadnavis government is not a farmer-friendly government, says Congress’ Radhakrishna Vikhe Patil, leader of opposition in the Assembly.

In the assembly, Fadnavis announced a massive Rs 25,000 crore input into the agriculture sector over the next five years, a programme to bring 22 lakh farm families in the 14 worst-affected districts under the food security ambit, another programme to bear the education expenses of children whose parent/s have committed suicides, extension of the government health scheme to reach families in farm distress, and a plan to create 1.5 lakh farm ponds and a lakh farm wells so that farmers are not dependent only on the monsoon – but no loan waiver.

Short-term versus long-term

The programmes to make farmers debt-free come on the back of nearly Rs 4,600 crore that the Fadnavis government has announced as relief so far, but, as in Wadad village, this relief has not reached all the intended beneficiaries. Relief and restructuring debt helps but waiving off debt does not help farmers because it only enriches banks and bogus middlemen, is Fadnavis’s contention.

This was seen in the debt waiver scheme of 2008. As part of the Centre’s Agriculture Debt Waiver and Debt Relief Scheme of the Dr Manmohan Singh government, Maharashtra got nearly Rs 10,000 crore. Two years before that, as farmers suicides in Vidarbha escalated, the central and state governments had extended relief and waiver of nearly Rs 6,000 crore. The debt waiver and one-time settlement package covered nearly 78 lakh farmers, with debt of around Rs 14,000 crore either written off or rescheduled, the state government had then claimed.

Subsequently, several evaluation reports, including of the Comptroller and Auditor General and of the country’s apex national agricultural bank NABARD, noted problems in the measures. There was inequitable distribution of relief, with over 53% going to farmers in western Maharashtra while the then crisis-ridden Vidarbha got barely 20%; the waiver helped only a fraction of the indebted farmers because the majority were outside the formal banking system and relied on moneylenders; and around 22% of the bank accounts that received relief showed wrongdoings.

There were also reports of how non-farm loans were being restructured under this scheme. Five years on, banks were sending out letters to recover money from “ineligible” beneficiaries.

Fadnavis, indeed, has a point about the abuse or misuse of the debt waiver. It turned into another scam. Given this and their dodgy track records on getting the debt relief to the intended beneficiaries or resolving the farm crisis, neither the Congress nor the NCP sound convincing about their newfound empathy for farmers. In fact, NCP chief Sharad Pawar, as the country’s agriculture minister, was adamantly against a debt waiver on the grounds that “the banks and government will go bankrupt”.

The Congress recently launched district-wise agitations on the issue but hardly made an impact. Both the parties are making the right noises now and projecting themselves as saviours of farmers in distress. It is cynical posturing. Equally, Fadnavis does not want to touch the debt waiver theme at all because it is the opposition’s demand.

His long-term programmes and strategies to make farmers debt-free may deliver results. The western Maharashtra model that has been started in Yavatmal (Vidarbha) and Osmanabad (Marathwada) to supplement farm income through agri-businesses, rearing animals such as goats and pigs, and planting coconut and other trees may yield outcomes that can be replicated in the other crisis-prone districts.

But why should any of these and other measures preclude an immediate debt waiver? It could be a life-saver for many farmers staring at yet another crop failure and already caught deep in the vicious debt cycle. A waiver, implemented properly, may just make the difference between life and death for thousands in a sector that witnessed negative growth in the last three years. After all, the Fadnavis government, as the opposition pointed out, was spending Rs 3,000 crore to make the state’s roads toll-free and abolish the local body tax, and offering thousands of crores to Nepal for earthquake relief.